May 2024 Market Update

As we move into winter of 2024, the catch phrase of my newsletter a few months ago is ringing true – “winter is coming”. The new catch phrase in the economic circles is “survive till ‘25”. This month I unpack the good and the “less favourable” news of the month.

While I don’t like to dwell on the “less favorable”, I am aware of another property management company trying to entice our clients over to it by charging them more but giving a cash back. I am a tad embarrassed for them; the client essentially pays their own cash back. I’m open to that if it’s attractive to you but we’d rather you stay and keep your cash.

Latest OCR Announcement Unchanged

As predicted, the Reserve Bank of New Zealand (RBNZ) has left the official cash rate (OCR) unchanged at 5.5%, in an announcement made on Wednesday 22 May. The commentary around the consideration to increase the current rate can be dismissed as nothing more than sabre rattling.

RBNZ’s general economic forecasts were also largely unaltered, although it’s now thought that we might expect interest rates to remain higher for longer than had been previously suggested. This is because the desired return of inflation to the 1 – 3% target band has been pushed back to Q4, rather than the earlier Q3 expectation. As inflation may also stay high in 2025, there was no overall surprise that the OCR has remained on a higher track too.

According to figures that RBNZ released alongside the OCR announcement, New Zealand has come out of the technical recession announced earlier this year. However, GDP (gross domestic product) growth will be highly restricted during 2024 – 25, with unemployment likely to rise due to overall job market stagnation.

While factors such as bank competition and offshore finance rates also having a part to play in mortgage rate settings, the fact that an OCR cut is now more likely to happen in 2025 than 2024, means it’s sensible to expect a similar story for mortgage rates.

This means that conditions for new borrowers and those with existing mortgages (who will need to reprice up to current market rates) seem likely to remain challenging for at least another six to nine months. Even if mortgage rates start to fall more substantially in 2025, that would coincide with the limiting influence of the expected debt-to-income restrictions. Home loan cuts now appear to be “a story for next year”.

Upcoming Legislation Changes – Bright Line Rule Changes 1 July 2024

There are a few changes coming up before the end of the year, the first being changes to the bright-line property rule.

From 1 July 2024, the bright-line property rule is changing, here’s what you need to know:

· If you sell your property after 1 July 2024, the bright-line property rule will only apply if the property is sold within two years of purchasing it

· If you sell a property before 1 July 2024, the current bright-line periods still apply

· If you bought the property between 29 March 2018 and 26 March 2021, the bright-line property rule applies if you sell the property within five years of buying it

· If you bought the property on or after 27 March 2021, the bright-line property rule applies if you sell the property within five years for qualifying new builds or within 10 years for another residential property

· Generally, the bright-line rule does not apply if you sell your main home

Of course, for long term buy and hold investors these rule changes won’t have a huge impact. However, if you’re looking for investment opportunities, there may be some people looking to offload over leveraged properties when the new rules take place. We won’t really know until July how that will flow through to the market. In a market already flush with available listings and a shortage on rentals, will selling out of the rental pool put further pressure on the shortage of supply and potentially rents? Only time will tell on that one.

House Prices Still Rising

In saying that, for the time being, New Zealand’s property prices have recorded a year-on-year increase for the third consecutive month according to Trade Me's Property Price Index for April.

The national average asking price for a property was recorded at $878,100, up 1.8% compared to the same time last year.

"New Zealand's property prices have been going up for three months in a row now when we look at the year-on-year data. But as autumn sets in, things might ease a bit as we head into winter when buyer activity tends to slow down. We have seen prices come down when we look at the month-on-month data after the peak of summer.”

“It's important to remain cautious as the majority of these increases have been minor - we will be watching the market to see if this trend will keep going or if it'll start to slow down," said Trade Me Spokesperson Casey Wylde.

In the South Island, Christchurch is still seeing the biggest increases in properties with four bedrooms or less. The garden city recorded a record high for properties with 1-2 bedrooms, the average asking price was recorded at $548,250 up 2.4%.

Properties with 3-4 bedrooms also increased, up 4.9% to $777,800 which is almost an extra $40,000 compared to the same time last year. However larger properties with five or more bedrooms have come back down after jumping in April, down 4.8% to $1,133,700.

Introduction of Debt-To-Income Ratios (DTIs)

Also with that on 1 July, comes the introduction of the long-expected debt-to-income ratios (DTIs) and the loosening of loan-to-value ratios (LVRs).

Debt to income pretty much means as read - the amount of debt a borrower has taken on relative to their gross, or pre-tax income. If you’ve borrowed four times your income, you have a DTI ratio of four. If you’ve borrowed eight times your income, your DTI ratio is eight.

The RBNZ is limiting the amount of high-DTI lending banks can make.

From 1 July, banks will be able to make 20% of new owner-occupier lending to borrowers with a DTI ratio over six and 20% of new investor lending to borrowers with a DTI ratio over seven. LVRs limit the amount of low-deposit lending banks can offer.

At the moment, 15% of new lending can go to owner-occupier borrowers with less than 20% deposit. From 1 July, banks will be able to make 20% of that lending to low-deposit borrowers.

The limit on low-deposit lending to investors will stay at 5%, but the required deposit will drop from 40% to 35%. Commentators don’t expect it to make a huge difference, although it could make things easier for first home buyers, who often find it harder to get a deposit together.

RBNZ Deputy Governor Christian Hawkesby said DTIs and LVRs work together to reduce the build-up of high-risk lending.

“LVRs target the impact of defaults by reducing the number of potential losses in the event of a housing down-turn, while DTIs reduce the probability of default by targeting the ability of borrowers to continue to repay debt,” Hawkesby said.

“Having both DTI and LVR restrictions in place at the same time means we can better focus them on the risks that they are designed for while achieving the same or better overall level of resilience in the financial system.”

The Residential Tenancies Act (RTA) Amendment Bill 2024

The RTA Amendment Bill 2024 was introduced to Parliament on 21 May and passed its First Reading. The Bill will reverse a few of the notable changes made to the RTA by the last Government and introduce the much talked about Pet Bond.

The National-led Government says that the Bill, which is now taking feedback at Select Committee, will remove barriers to rental supply and incentivise property owners to rent their properties via the private rental market.

“The Government’s sensible pro-tenant changes to the Residential Tenancies Act, alongside the introduction of interest deductibility, will help increase the supply of rental properties by giving landlords the confidence to enter or re-enter the private rental market, and it will give people a better chance to secure a rental,” Housing Minister Chris Bishop said.

The Bill is set to reintroduce 90-day ‘no cause’ terminations for periodic tenancies without requiring a specific ground for ending the tenancy and amend Section 60A so that a fixed term can end without a reason being provided by a landlord. Also, 42 day notices will be reintroduced for the owner, or their family member, who wish to reclaim the rental property as their main residence and also when a property is marketed or unconditionally sold.

The much talked about Pet Bonds also feature on the Bill as new sections of the RTA.

The Bill amends the RTA so that a ‘pet bond’ may be required by landlords up to a maximum value of two weeks’ rent (in addition to the regular rental bond).

In order to keep a pet in a rental property, the Bill requires the tenant to obtain written consent from their landlord, who may only refuse on reasonable grounds.

The non-exhaustive list of reasonable grounds for refusing a tenant’s request to keep a pet in a rental property listed in the Bill are:

· The premises are not suitable for the pet or pets (for example, because of the size or fencing of the premises, or other unique features of the premises);

· A relevant bylaw or body corporate operational rule made under the Unit Titles Act 2010 prohibits the pet or pets from being kept on the premises;

· The tenant has not complied with relevant bylaws relating to the pet or pets;

· The pet or pets are not suitable for the property:

· Due to size, type, breed, or propensity for causing damage to premises or disruption to other persons residing in the neighbourhood; or

· Because it is, or they include, a dog that has been classified as dangerous or menacing under the Dog Control Act 1996; or

· Because there is good reason to believe it has, or they have, previously attacked persons or other animals;

· The tenant has not agreed with a reasonable condition to which the landlord proposes to make the tenancy agreement or the consent subject.

The Bill makes tenants fully liable for careless and accidental pet-related damage that is beyond fair wear and tear.

The Bill, amongst other changes, includes pet consent and bond-related infringement offences, unlawful acts, and associated penalties to support compliance with the new rules.

Most of the changes are expected to be law by early next year with the Pet Bond change expected to come into law in late 2025. So, some good news there, though it’s not going to happen overnight with those time frames, however it is always good to have something to look forward to.

Record-Breaking Rents Hit All-Time High In March BUT Have They Peaked?

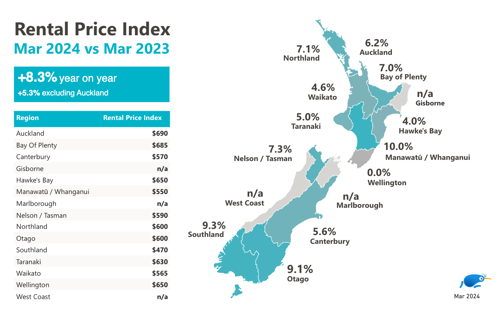

New Zealand's national rental prices have hit an all-time high, according to Trade Me's latest Rental Price Index.

The data reveals that the national median rent had jumped to a record-breaking $650 per week in the month of March, up 8.3% compared to March 2023.

Trade Me’s Property Sales Director Gavin Lloyd said that this was well above average. "On average rents have increased by about 6% annually. While it's not the biggest annual increase we've ever seen, it is unusual to see it this high in March. We'd normally expect to see the market cool slightly as we exit summer and start heading into the colder months," he said. "Renters are now having to fork out $50 a week more on average than they were in March 2023. That's an extra $2,600 a year which will no doubt be putting pressure on Kiwis who are already doing it tough," said Lloyd.

The sharpest increase was seen in the Manawatu/Whanganui region which was up 10% on March 2023 at $550, while the Wellington region saw no change remaining at $650.

Demand is down and supply is up in the rental market for the second month in a row. Compared with the same time in 2023, there were 22% fewer enquiries and 3% more properties available in March.

Mr Lloyd says that although this has happened from time to time over the past few years, things are looking different now. "What we're seeing now is that compared to a year ago, demand has been trending down since November."

"And on the supply side it's a similar story. It's become normal to see supply contracting but those drops in supply have been shrinking and now we're seeing a 3% increase in the number of properties available compared to last year," he added.

Lloyd pointed out that although supply is catching up with demand, there's still a mismatch. "There's likely still a way to go before supply catches up with demand, but this is a really encouraging sign. If this continues, with fewer people competing for more properties we'd expect to see prices stabilise or even fall which of course will be welcome news for renters looking for a new home."

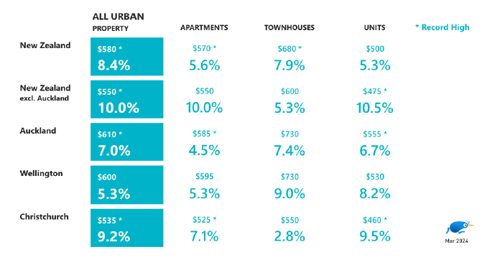

Apartments, townhouses and units are in hot demand across the motu, together jumping to a record-breaking average of $580 per week in March, 8.4% more than the same time last year.

Surprisingly, prices are growing faster outside of the main city centres with 10% growth to a record $550 when Auckland is excluded.

Mr Lloyd says this shows that more Kiwis in more places are beginning to embrace urban lifestyles and are happy to trade a bit of space for a great location.

He added that the rising cost of living has changed the way many people think about moving around our cities. Despite townhouse rents generally being slightly higher, Lloyd said that their convenience can sometimes offset the extra rent.

"Apartments and townhouses tend to be near good quality public transport, if not within walking distance of places people want to get to. If that means you can leave your car at home a few days a week, it can make a big difference to the wallet," he said.

In Poneke, average rent for townhouses jumped 9% compared with March last year - despite the capital seeing no change in overall rents across the same period.

Further south, Christchurch was seeing a notable jump in price for units reaching a record $460, up 9.5%. Apartments were up too, also a record high at $525. "Throughout the rebuild of Christchurch, the city has really embraced more compact urban living," said Lloyd.

And To The Local Market…

This month we’ve seen a large correction in the supply and demand curves, with the gap narrowing between the two. The number of available properties has shifted to nearly 900 - a far cry from the low 600’s we experienced months back.

On the back of that we have seen enquiry rates fall back, this is twofold, one there is more supply and two, that motivation for folks to move is seasonally adjusted. Back in the days of fixed term tenancies we seldom used to end tenancies in June to September for that reason, it is a tough time for letting.

Rates, insurances and rents have been singled out as the latent cause of lingering inflation. These non-tradeable sources are proving to be stubborn and the RBNZ is waiting and hoping that they’ll resolve to reduce the overall inflation picture. I mentioned earlier this year that the market will come to a point where it won’t tolerate much more rent pressure and I feel we are close to or are at that point. With the increase in supply and tapering of demand, the pressure comes off rents as the challenge to fill vacant properties steps up. We’ve already seen some under cutting within the local market as multi-unit developments come to market and scramble to tenant as soon as possible. In saying that, as rent reviews roll through, they’ll still be adjusted to current market but I feel the lid will be on the large increases we have seen.

Vacancy rate, as opposed to maximum possible rent, should be the focus when it comes to achieving maximum return on a per annum basis. Any vacancy even at $520 a week is a $10 difference per week in potential rent to achieve the same annual result, so essentially the property could be let for $510 and maximum occupancy and achieve the same result. I’m not saying we aren’t going to be keeping rents at market but mindful the big increases may well have seen their time for now.

As always, do do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.

Hamish and the Team @ A1