September 2023 Market Update

It is a beautiful day here in Christchurch to mark the first day of Spring 2023 - hard to beat a nice, crisp start to a clear and cloudless day in the garden city. Before we know it, in 23 days, daylight saving will start again on 24 September.

It’s All Go in Wellington

Goodness, the various political parties are really starting to ramp up their electioneering as we head for the General Election in 44 days. With so much spin doctoring it’s difficult to sift the quality from the quantity. Some clear policies that would benefit investors are immerging in more detail as time goes on. It will be interesting to see if the left drifts slightly more central as we get closer to crunch time. Surely, even they can see that their various policies haven’t had their intended outcomes and some ‘adjustment’ is required.

It would seem there are some head winds facing whatever central government forms post October. With a fiscal blow out hiding in the closets of Treasury and the required but potentially painful tightening of government spending. National has quantified a $594m on average per year reduction in spending on back-office functions in government departments, excluding non-core and frontline agencies. $400m on average per year reduction in government spending on consultants. $590m on average per year Climate Dividend, using the Emissions Trading Scheme. They are some big numbers to be throwing around.

Crystal Ball Required for OCR and Interest Rates

Just as the myriad of factors that have influence on the OCR and our domestic interest rates seemed to have been falling in line for it to be reasonably predictable as to where things were headed in the last month...there have been a number of foxes in the hen house.

One saying is, “If farming, in general, sneezes, the whole country gets a cold”, well this month Fonterra has cut its farmgate milk price forecast for the second time in a fortnight after global dairy prices plunged at the latest auction. Economists say the drop in milk price will lower farmer incomes by about $2.2 billion, denting rural spending and weighing on the wider economy. “Farmers are going to be finding it pretty challenging,” said ASB chief economist Nick Tuffley. “The belt will be pretty tight.”

Global dairy prices have weakened amid lacklustre demand from China, the world’s largest dairy market and Fonterra’s biggest market for whole milk powder.

So, we have a $2.2b reduction in earnings and a potential $1.5b reduction in government spending on the horizon, essentially a $3.7b handbrake on the momentum that we’d seen through the early part of the year. Add to that when last week, Statistics New Zealand released data telling us what happened with retail spending during the June quarter. The main outcome of a 1% fall in sales after adjusting for inflation and seasonal effects was weaker than generally expected. This suggests that the economy is performing less strongly than anticipated by the Reserve Bank and strengthens the case for the official cash rate coming down much sooner than the late-2024 timing which the Reserve Bank have pencilled in, wouldn’t that be nice!

Tony Alexander reports that spending has shrunk for five of the last six quarters. When you look at the year to June, spending on retail goods and services fell by 1.7% after inflation. This is the weakest growth (greatest shrinkage) since the Global Financial Crisis and there are many factors behind this situation. Top of the list is tight monetary policy. The explicit intention of the Reserve Bank when it raises interest rates is that people with mortgages feel the pinch and cut back on their spending. They also want to see weakness in the labour market and people made unemployed who will then also cut back on their spending.

As a major trading partner with China and China experiencing what most are saying is their most unprecedented economic downturn in the last 40 years and that weakness in China has already seen NZ’s export receipts from there fall 24% in July from a year ago with only 0.1% growth for the year ended July. Our export receipts from all countries were 4.2% lower in the three months to July than a year earlier. Weakness in incomes for exporters is likely to persist outside the tourism sector for the coming year and this will especially crimp retail spending in the regions then with a lag the cities. The lag will be longest for Wellington and shortest for Dunedin.

If the pot isn’t full yet, the unemployment rate has already lifted from 3.2% to 3.6% and is likely headed towards 5%.

So, it would be fair to say the picture is now getting very cloudy. There is upward pressure on interest rates from the better-than-expected performance of the US economy which is leading to reduced expectations of easing monetary policy there over 2024. That has caused medium to long term interest rates to rise and generated upward pressure here as well.

Tony Alexander feels “upward pressure is for now comfortably offsetting any downward pressure coming from the deteriorating outlook for China’s economy. The worse China looks the greater the weakness in our exports and our economy. But that weakness hits with a lag and it won’t be until very late this year that the Reserve Bank will likely explicitly factor in the downward pressure on our inflation now expected to come from China’s weakness and its falling prices. For now, NZ bank wholesale funding costs continue to rise and there is a round of increases underway (again) in fixed mortgage rates for 2 years and beyond.”

Quite the puzzle that one!

Trademe Data and The Local Market Update

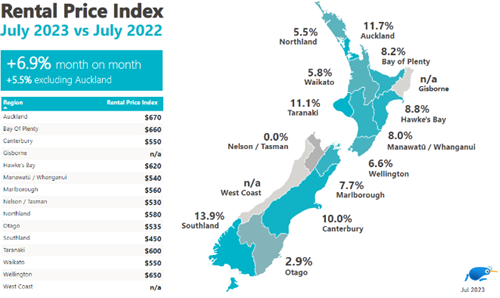

The New Zealand rental market cooled in July with rents stagnant, demand down and supply falling, according to Trade Me’s latest Rental Price Index. The national median weekly rent held steady at $620 for the second consecutive month in July.

Prices in Canterbury remained stable with a median rent of $550 per week, where rents have remained since May.

Trade Me’s Director of Property Sales Gavin Lloyd said “Canterbury has been fairly steady, but renters are still paying $50 a week more than this time last year. In Christchurch rents reached a new record in July at $550 per week, up 10 per cent on the year prior. This will be hurting the pockets of renters as they face cost of living increases across the board,”

With our services covering the greater Christchurch area from Pegasus, Ravenswood and Rangiora in the north to our dedicated Rolleston office covering Lincoln, Rolleston and Prebbleton in the south we have a vast insight to the rental pool across the city.

So, what’s happening out there you ask? Well, simply put, demand is still outstripping supply in most sectors. This means that even with an average amount of tenant churn properties are letting with, in most cases, a rental uplift within two or so weeks. The pain points are where supply is on par or ahead of supply. Now that doesn’t result in the property being vacant forever, it translates into less rental pressure and a slightly longer time to let. We haven’t come across a property in the last 27 years that hasn’t been able to be let. I like to say there is a property for everyone.

The sweet spot at the moment seems to be three bedroom, either one or two bathroom properties with garaging. Why? Simply because as far as developments go the two bedroom or four bedroom properties have had the lions share of the numbers, leaving a sector of the pool under stocked.

Today, as a write this, we have 700ish properties available across the city for rent on Trademe. This is still short of where I see the equilibrium of supply and demand. It is what’s keeping the pressure on rents to hold their own and move upwards to maintain what are now record levels.

Fun fact for you - our office solar panels have saved the equivalent of 5.01 tonnes of coal and reduced 5.95 tonnes of CO2 emissions - which is the same as nine trees having been planted. More on the office’s efforts to reduce our carbon footprint next time.

As always, we do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.

Hamish and the Team @A1