August 2023 Market Update

Well, there has been plenty going on in New Zealand this month, from sporting highlights, OCR announcements, FIFA Women’s World Cup and the retention of the Bledisloe Cup - it’s been all go!! All that and it’s only just on a year since the borders reopened post the COVID lockdowns, things have definitely moved on since those times.

Keep An Eye On Policy And Election Manifesto’s

Like most property investors, I’m on a 74 day count down to the general election on 14 October. There seems to be a significant amount at stake for those that choose to provide housing for the benefit of others this election. With the left and the right having significantly different views and policies for landlords and investors going forward.

It was refreshing to hear Chris Hipkins rule out a wealth and capital gains tax mid-month. “I’m confirming today that under a Government I lead there will be no wealth or capital gains tax after the election. End of story.”

He said, “now is simply not the time for a big shake-up of our tax system”.

Finance Minister, Grant Robertson, said there had been work “on a range of proposals for a tax switch” in the Budget 2023 process.

Hipkins said in a statement on 12 July “while work was already under way on a potential wealth tax and CGT as part of a tax switch in the Budget, I ultimately made the call not to proceed with it”.

It would seem that his key coalition partners didn’t get the memo as both have come out with a raft of additional tax policies. Te Pāti Maōri has announced its tax policies for the 2023 election, including new taxes on wealth, foreign companies, undeveloped land and vacant houses.

Co-leaders, Rawiri Waititi and Debbie Ngarewa-Packer, say their policies would redistribute wealth, changing a system that takes from the poor to give to the rich.

The policy includes adjusting income taxes, with a tax-free bracket for earnings under $30,000, and a new 48% tax on income over $300,000.

The Greens also came out with their election manifesto, from their long wish list, the party co-leaders singled out housing, climate resilience and wealth redistribution as the main priorities at this stage.

In housing and wealth, especially with calls for rent controls and wealth taxes, the Greens find themselves at odds with Labour.

Davidson mentioned Prime Minister, Chris Hipkins, only once during her speech, and that was in relation to rent controls.

“The prime minister may well have ruled out rent controls, but if the 1.5 million people who rent want a party that will uphold their right to a safe, healthy, affordable home and if people want better incomes paid for by a fair tax system, then that’s a vote for the Green Party,” she said.

National and Act seem to be somewhat on the same page with their views on repealing the loss of interest cost deductibility, the bright-line text extension and the 39% top income tax rate.

Each party has its own merits but for those owners that are feeling the fiscal squeeze, there appears to only be two that are offering any realisable relief in the short term at the moment.

OCR And Interest Rates

It’s now older news that the Reserve Bank has kept the official cash rate on hold at 5.5% after reviewing its monetary policy on 12 July.

But it added some spice to the announcement by saying it believed that house prices were “now around sustainable levels” after their recent falls.

Average mortgage rates, on outstanding loans, had increased from about 3% in early 2022 to about 5% today and based on current commercial bank pricing, average mortgage rates were expected to reach about 6% early next year, it said.

The Reserve Bank’s current forecast, which was not formally updated on 12 July, suggests the next move in the OCR will be downwards, with the first cut tipped around the end of next year, although many economists are expecting cuts to come sooner.

At the moment there is an extra element of confusion afoot and it revolves around the way banks here have raised their fixed mortgage rates recently, despite the Reserve Bank stating in May that they didn’t feel rates needed to go any higher. In fact, they have stopped increasing the official cash rate. But in spite of their no change position, which was completely factored into financial market pricing of fixed rate debt, ahead of last week’s cash rate review, banks raised their fixed rates again.

Why Have Fixed Mortgage Rates Gone Up In Spite Of The Reserve Bank Not Seeking Such Increases?

Well known Economist Tony Alexander explains the main reasons…

When a bank lends at a two-year fixed rate to you and they do not fund that loan by borrowing at a floating rate, it is very dangerous, because if floating rates should rise due to new inflation concerns, their profit will be slashed. However, if rates fall, profit will be boosted. But if a bank wishes to take a view on what short-term interest rates are going to do, then that view is implemented in their Treasury division where exposure to risk is monitored and tightly controlled on a minute-to-minute basis.

The bank will fund the loan by borrowing at a two-year fixed rate in the wholesale market. This is called the swap rate – though the name doesn’t matter. If the two-year wholesale interest rate goes up, then a bank will eventually raise their two-year fixed lending rate. But this does not happen immediately.

It can cause problems for staff processing loans when fixed rates change quickly and there is a risk of reputational damage if fixed rates chop and change quickly up and down. So, when the cost to a bank of lending fixed changes, the bank will want to be reasonably sure that the change will be sustained before they change their lending rate.

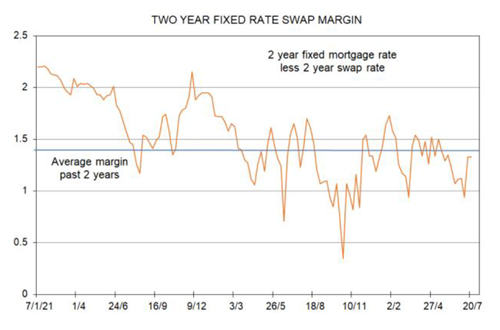

This means the margin between what a bank pays and the rate it lends at can change. I attempt to show such margin shifts each week in my graph including this one for the two-year term.

The orange line measuring the margin goes all over the place. The blue straight line is the average margin for the past two years. Note how the margin fell below average between May and early-July as banks did not respond to rising wholesale interest rates. They have now responded. But the margin is still below average.

We don’t know what margin they are targeting. But the graph can give insight into where bank mortgage rates may or may not go and the signal recently has been that they would probably go up.

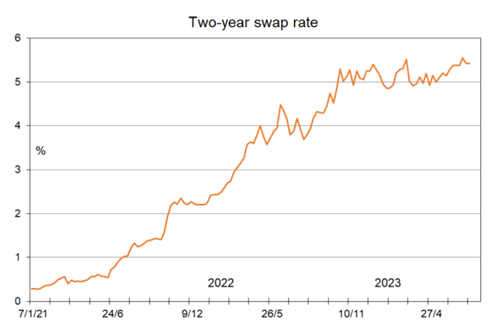

The question now becomes why did bank wholesale funding costs go up despite the Reserve Bank’s expression of happiness about where inflation is heading? This next graph shows that the two-year swap rate rose from 5% in the second week of May to almost 5.6% in the first week of July.

This 0.6% rise was not driven by new inflation worries in New Zealand. We have in fact seen good declines in local gauges of inflation expectations and capacity pressures. Instead, the rise in local borrowing costs has been driven by higher interest rates in the United States.

Trademe Data And The Local Market Update

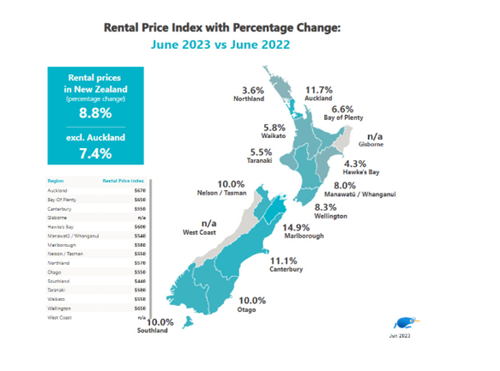

Tenants are, on average paying $50 per week more compared to this time last year, according to Trade Me’s latest Rental Price Index.

New Zealand’s median weekly rent rose 9% on last year to reach a new record of $620 per week in June, says Trade Me’s Director of Property Sales, Gavin Lloyd.

“$50 extra a week adds up for tenants – that’s $2,600 more a year in rent,” Mr Lloyd said.

“In this economy, costs are increasing across the board and this is hitting renters hard. Landlords are still feeling confident to put up prices, but this might be reaching a peak as the confirmed recession, cost of living and lack of disposable income hits tenants,” Mr Lloyd said.

“Despite the annual increase, rental prices do seem to be slowing in some regions. Over the coming months we expect many tenants will choose to stay where they are rather than look for a new rental, which should cause prices to drop or at least steady.”

The demand for apartments, townhouses and units continues in all urban centres.

Apartments across the board were popular in June, with rents for apartments in Auckland and Christchurch reaching new record highs of $575 and $500 per week, respectively.

Townhouses were also in demand, with Auckland townhouses up 4% to an average of $710 per week.

“We are seeing a lot of demand in the major cities, with people choosing apartments and townhouses that are smaller, warmer and drier, but also close to the city, which may be helping people save transport and other costs,” said Mr Lloyd.

Locally we’ve seen supply jump over 200 properties this month. The student letting season will account for this lift in supply as we see it’s very much the same as last month with general listings. The amount of mover enquiry has tapered off as per normal in winter. Families are settled in schools and the colder and very much wetter weather does quell enthusiasm at this time of the year.

Rental Payments With Banks Shifting To Seven-Day Processing

This is a recent change for transactions in New Zealand dollars between all of New Zealand’s participating banks are to be processed every day. Participating banks are ANZ, ASB, BNZ, Bank of China, ICBC, Citi, HSBC, Kiwibank, TSB and Westpac.

The Co-Operative Bank and SBS are not members of Payments NZ but are also making the change.

This means the previous policy that payments only move on business days now allows for weekend payments. This will mean that any rental payments made after 7.30pm on a Friday will be receiptable by us on a Monday as what would have traditionally been a Tuesday.

A reminder that we payout on the 15th and 1st of each month unless those dates happen to fall on the weekend or public holiday, it will be the next business day.

As always, we do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.

Hamish and the Team @A1