October 2025 Market Update

October sure has been an interesting one here, the weather to say the least, OCR falls, LVR restrictions set to be loosened, the local market and Christchurch as a whole leading the way in housing across the country.

Let’s stay a bit closer to home with this month’s news…

Reserve Bank to Loosen Mortgage Lending Rules After Cutting OCR

Great news for investors as Loan-to-value ratio (LVR) restrictions on mortgage lending will be loosened from December, the Reserve Bank says.

From 1 December, the share of new lending to owner-occupiers allowed by retail banks, with an LVR above 80%, will rise to 25%, up from 20%.

For property investors, the share of new lending allowed with a LVR above 70% will increase to 10%, up from 5%.

Debt to income (DTI) restrictions had also been reviewed, but the Reserve Bank had decided to leave those settings unchanged.

That news was a week after the RBNZ cut the Official Cash Rate (OCR) by 50 basis points (bps) to 2.5%. This was not a surprise to most, grim economic conditions had most thinking the RBNZ would have to cut the OCR aggressively to provide stimulus.

ANZ was the first bank to lower interest rates following the cut to the OCR. The bank said it would cut its flexible and floating home loan rates by 40bps. Its floating home loan rate will be 5.89%, while the flexible rate will be 6.00%.

“The good news is that lower interest rates are helping, and more and more customers are seeing the benefit of rate cuts,” ANZ's Grant Knuckey said.

Westpac followed, saying it was cutting its variable home loan rates by 0.30% effective immediately, making its floating and offset rates 6.09%, and its everyday rate 6.19%.

The bank's 2-year fixed term rate was reduced to 4.49%.

“While there’s still economic uncertainty out there, falling lending rates should continue to give homeowners and businesses greater confidence about the year ahead," Westpac's Sarah Hearn said.

ASB also said it was cutting rates in response to the OCR drop, with its variable home loan rate falling to 5.99%.

ANZ, ASB, Westpac, BNZ and Kiwibank all have one-year rates at 4.49% after earlier cuts.

The question being - is that it? November 26 is the next review, as always adjusting the OCR is like turning a super tanker, it takes a while for any adjustments to be noticed. Will the RBNZ hold its nerve and wait for the 50-point reduction to kick in or are they going to cut another 25 basis points to 2.25%?

Inflation is a line cutter at the moment - 3% being the top of the comfort zone with the expectation that some of the non-tradeable inflationary pressures in that will taper off into Q1 next year. Personally, I feel the country as a whole needs one last cut to cement in the stimulus the RBNZ is trying to generate.

I was lucky enough to have a great chat with the lead economist of one of our main banks. His view was there will be one last cut, then a period of holds before a gradual rise towards the end of 2026. Adding to that, he sees the one-year rate being a flat 4% or even 3.99% in the near future. Sounds good to me! We live in hope that he’s on the money.

Christchurch Property Market Still On Top

Christchurch is holding on to its spot as one of the most stable property markets in the country, while values fell even further in Auckland and Wellington.

Cotality’s monthly housing report for September showed modest growth in Christchurch and Tauranga, as well as Gisborne, New Plymouth, and Invercargill.

Wellington had the largest drop in median values in the country - now down 25.1% from the pandemic peak and a further 0.8% in the third quarter of the year.

Cotality’s Chief Property Economist Kelvin Davidson said property buyers were enjoying favourable conditions. In particular, first-home buyers set a new national record in September, accounting for more than 28% of all purchases.

With the LVR rules set to loosen, as I mentioned before, there may be more room for them to take advantage.

The good news is that Christchurch continued to have one of the most stable property markets with a 0.4% rise over three months - the only main centre to rise other than Tauranga which went up 1.2% in the same quarter.

Christchurch also has the smallest decline in values since the peak during the pandemic - down 4.3%, compared to many places which had double-digit falls.

Davidson said September sales volumes, across both private deals and real estate agents, were nearly 4% higher than the same time last year.

Interestingly, Cotality’s tracking of mortgages shows around 64% of New Zealand’s existing mortgages by value were currently on fixed terms, but were due to reprice over the next 12 months. Of those, 32% would roll over within six months, while another 12% were on floating rates. The bulk of mortgage-holders will see reduced repayments in the near term, which will give them a choice with additional cash flow. With rates being 6.35% this time last year, there’s definitely opportunities presenting themselves.

And So, It Starts…. Electioneering

I see our friends on the left have promised that if elected to govern (along with the Green and Maori parties) in next year’s election they will introduce another tax. They plan taxing all capital gains upon the sale of all commercial and residential properties which are not the family home after 1 July 2027. The calculations will be from then and not retrospective. This tax will capture any property apart from your own home, so a holiday house, bach, farm house etc that is not your own residence is up for grabs.

The buy line is that the tax is to pay for three free doctors’ visits for everyone including those that are healthy and don’t need or expect such a subsidy. It seems they believe it will lead to capital being directed towards productive activities – seeing that building and supplying houses for the country’s population is not productive?

Really, it’s a change to the brightline, from the current two years to an open-ended scenario - we will get you in the end.

I’m sure this is just the start of the drum beating, with both sides upping the tempo early next year no doubt.

Stadium Zone Fast Becoming Hot Property

The $683 million One New Zealand Stadium is due to open April 2026 but is already making it’s presence felt.

Commercial land values in the area and around Cashel Street have “about doubled” in the past five years. There’s no hiding from the fact that there has been a lot of changes and the stadium isn’t even complete yet.

New hospitality businesses are improving amenities, while townhouse developments are boosting foot traffic. “The Stadium” precinct as it’s known stretches from Barbadoes Street to Fitzgerald Avenue, East to West, and from Hereford Street to St Asaph Street, North to South. The rezoning of the area as mixed-use, both commercial and residential, has also helped attract new businesses and housing projects.

When the stadium is finished and operational it’s going to be a huge draw card, the area will continue to evolve with more demand for residential property. With more residential comes the need for more amenities.

Salus Property agent Andrew Zhang, who specialises in residential sales said that within two years, he expects that property, and others nearby, to be worth about 20% more.

“I think we’ll be getting back to some of the peak pricing which we saw in about 2020 to 2021,” said Zhang.

Spring has sprung and so have the number of new listings on Trade Me Property with year-on-year supply up 5.9% and close to 19% from August. Meanwhile, property searches by prospective buyers skyrocketed, increasing by more than 24% compared to September 2024.

Rents - What’s Happening With Them?

We are continuing to see good levels of supply; this gives renters more options and time to find the property that suits them the best, in terms of the accommodation it provides and price. Properties need to go to market at best realistic market price in the current environment. When a property is priced above market value, it tends to sit and get overlooked, as there’s only so much the market will tolerate. We are seeing a very price sensitive market at the moment.

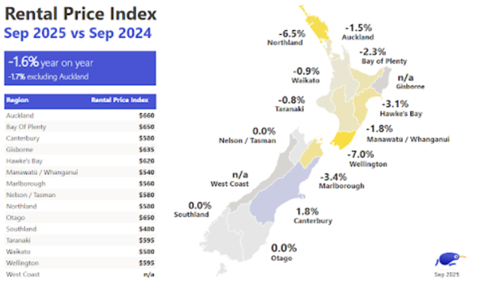

The national median weekly rent has held steady at $620 for September - however this is a slight drop of 1.6% compared to the same time last year.

Trade Me Property spokesperson, Casey Wylde said "The nationwide drop is consistent with an overall increase in rental properties becoming available". Ms Wylde noted "we have seen a 6.3% year-on-year increase in new listings nationally, which is putting downward pressure on prices."

Alongside Wellington, Northland (-6.5%), Marlborough (-3.4%) and Hawke’s Bay (-3.1%) recorded the most significant falls in rent year-on-year.

Auckland's median weekly rent saw a 1.5% year-on-year drop to $660, showing a slow but steady decline.

In contrast, Canterbury’s median rent increased 1.8% over the same period, the only one of 15 regions Trade Me Property monitors for rent to increase when compared to September 2024.

For the most part, rents are very much in line with this time last year. The good news is they are holding their current value in the face of a good amount of supply. We still have around 1150 properties currently available across the city. This sits just below the long-term average so helps prevent rent slippage.

The number of two-bedroom properties available has dropped back from 35% to 32%, easing some of the oversupply we’ve seen in that part of the market.

Pets for Christmas

As I mentioned in July, as part of the fourth phase of the Residential Tenancies Amendment Act 2024, the last of a major set of reforms is on the way and this time the spotlight is on pets. This new legislation comes in on 1 December 2025. We will email you directly with some more information on how that works and if you have any property specific factors that we need to note.

Also, if you wanting us to arrange gifts for your tenants can you please let your property management team know so they can sort these before the silly season is fully upon us.

As always, we do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.

Hamish and the Team @A1