May 2025 Market Update

Healthy Home Deadline 1 July

From 1 July 2025, all private rentals must meet the Healthy Homes Standards. This is the final compliance deadline for landlords who haven’t already had to meet the requirements. At the moment there is a 120-day grace period from the commencement of a tenancy for landlords to initially meet the standards, from 1 July the property will have to be fully compliant to be tenanted.

As mentioned last month the only area that won’t be easily detected is the insulation. Glass fibre (Pink Batts) settle and degrade over time, they are required to be 120mm thick as a minimum, for older properties with original ceiling insulation we will be keeping a particular interest to ensure compliance is meet.

One of our suppliers is offering $75 insulation inspections, with that $75 being refundable if you need an insulation top up and their quote is accepted. If your insulation level was 120mm we suggest it’s checked to ensure that your property is compliant. Your property manager can help you with that.

Insurance

This is a big ol’ topic and I don’t intend to cure your insomnia by writing a small novel on it but there are a few tips and tricks that might help you. At the end of the day everyone’s risk appetites are different. Insurance is not compulsory, I’m certainly not bullish enough not to have it but there is no requirement to have a property insured to have it tenanted. If you have a mortgage, then the bank will want their risk cover and they’ll say it’s mandatory.

When it comes to excesses, the majority of the time a voluntary increase in excess will save you hundreds on your policy price. In the event of an “accident”, your tenants are liable for the excess or the equivalent of four weeks rent whichever is the lesser. For example, take an average rent of $500, that’s $2000 per claim that the tenant’s maximum liability is. I like to set my excesses around the $1250 to $1500 mark, that saves around $200-$300 per annum on the premium and I still have exactly the same cover.

Are the add ons worth it? Well with mainstream insurers probably not. Loss of rent, landlords’ contents and additional damage really can cost. Real Landlord Insurance cover all that for $1 a day, so for $365 per annum, they offer a raft of protection. This is not a sales pitch for them but it’s pretty modest pricing with decent cover. They even cover loss of rent on the two-day Domestic Violence termination clause. Check out their website https://www.reallandlord.co.nz/ if you’re interested in what they do.

And The OCR Moved, No Real Surprise

On Wednesday last week, the Reserve Bank cut the OCR by 0.25%. That brings it down to 3.25%. New Zealand’s largest bank (ANZ) has cut its 1-year rate 11 times, over the last 18 months, it’s gone from 7.39% to 4.99%.

Some had called a bullish 50 basis points move was necessary to stimulate some recovery and growth but the Reserve Bank was a lot more guarded than that. What they did say that was surprising is that their modelling now suggests that the OCR might bottom out at 2.75% rather than the 3% they thought just 90 days ago, so another 50 points to go, maybe.

We shall have to wait and see how this last drop and the next, flush through. Most mortgage holders will need six months or more to take advantage of the newer rates being offered.

What is interesting with my investors hat on is that I can go and get bank funds at around 4.8%, buy a brand-new house and achieve a 5.5% (gross) return. So, the investment washes its face as we say, and money is getting even cheaper.

Add to that, Treasury has forecast average New Zealand house prices rising 4% this calendar year, 6% over 2026, 6.4% over 2027, and 5.6% over 2028. So, with money getting cheaper, the investment paying its way and forecast capital growth it’s a win-win all-round.

And To The Local Market…

What happens when Trade Me's Rental Property Index headline reads “NZ Rents fall for Second Month Straight”?. Well, our more learned tenants start emailing asking for a rent reduction. What we try to explain to them is that just because rents fall in one region or area, this doesn’t translate unfortunately to a nationwide reduction.

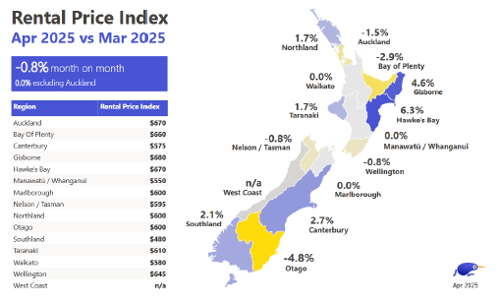

The national median rent has fallen for the second month in a row, confirming a shift in the rental market after summer and as we move into the winter period.

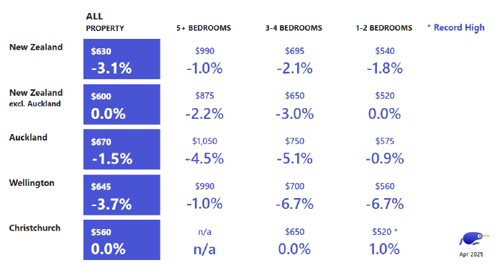

After holding steady in February, the median weekly rent saw a 0.8% drop in March, and another in April. This two-month pattern of decline contributes to an overall year-on-year decrease of 3.1% in the national median weekly rent according to Trademe data.

Trade Me Property Spokesperson Casey Wylde, notes, “with the median weekly rent sitting at $560 tenants are now paying around $20 less a week than they were in April 2024.”

As we try to explain to those seeking a rent reduction, the most significant median rent drops in April were recorded in Otago, down 4.8% to $600 per week, Bay of Plenty, down 2.9% to $660 and Auckland, which fell 1.5% to $670, no mention of Canterbury in those stats and in fact the picture is completely different here.

Canterbury stats show that we are 2.7% up from March.

Christchurch Small Units Up While Others Fall

Christchurch Small Units Up While Others Fall

Across the three main cities, the average median rent fell 3.1% in April with smaller 1-2 bedroom Christchurch rentals a notable exception, up 1% to $520 per week, a record high for this property type.

In contrast, Wellington and Auckland continue to see declines across most property sizes.

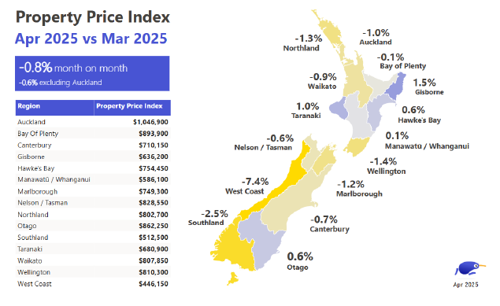

Values wise, it’s not surprising to see things cooling off as we head to winter.

Values wise, it’s not surprising to see things cooling off as we head to winter.

Prices have fallen for the second time this year, according to Trade Me’s Property Pulse Report. The average asking price for a property in April was $855,150, down 0.8 % on March and 2.6% year-on-year.

Trade Me Property Customer Director, Gavin Lloyd says house prices dipping at this stage of the year is somewhat typical and can largely be attributed to seasonal fluctuations.

“Historically, as we move into the colder months of the year we see a dip in buyer activity, and this is reflected in the most recent data. House hunting is a lot more appealing when the sun is shining and properties look and feel their best,” says Mr Lloyd.

As expected, the sales market somewhat mirrors the rental market in enthusiasm, waning away in the cooler, darker months.

Available properties here as shown on Trademe, are continuing to increase in number through to around 1240, which for me is the long-term equilibrium of supply and demand. It has been a very long time since we’ve seen those numbers available. The abundance of supply will reduce the pressure on the rents for the foreseeable future until supply is taken up.

Average days to rent are pushing out a bit - Christchurch 22, Selwyn 19, Rolleston 20 and Waimakariri 22, so all main areas are around the three week point.

As always, we do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.

Hamish and the Team @A1