March 2024 Market Update

Welcome to March, technically the start of autumn but I’d like to hang onto the thoughts of warm summer evenings and refreshing swims for just a bit longer yet. Eventually reality will catch up with me and next month I’ll be writing to you post Easter as we move into April.

Last month, I mentioned that we had experienced some frustrating interruptions with our software-based emails. Our software provider ensures us this is now resolved. Our software sent emails including statements etc will have an [email protected] address, you may need to update your spam filters if you don’t receive your next statement. Naturally, you are still able to email your team direct and are always able to reach us via [email protected].

Where To Look First

This month, I’ve felt a bit like a kid in a lolly shop, not really knowing where to look first. Politically there has been a lot going on and there doesn’t really appear to be too much sign of a settled cohesive approach. The markets wait and watch, looking for security within that space, before finding their way.

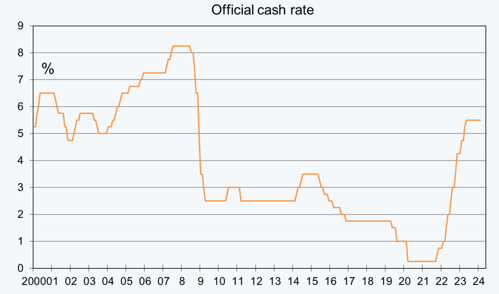

OCR Holds Firm

Thankfully, ANZ’s prediction of a lift in the OCR did not come to fruition on Wednesday when the RBNZ delivered its monetary policy update. The committee said in its statement that slowing demand in the economy, which it expects to continue, meant that the current rate was doing its job. “Core inflation and most measures of inflation expectations have declined, and the risks to the inflation outlook have become more balanced,” the bank said in the statement. It did go on to say that the current inflation rate - 4.7% - was still too far outside the bank’s target band of 1% to 3%, “limiting the committee’s ability to tolerate upside inflation surprises”.

The bank also sounded a warning that it is confident that the current interest rate is restricting demand in the economy, that “sustained decline in capacity pressure” will be required to keep inflation on its current downward track. “The OCR needs to remain at a restrictive level for a sustained period of time to ensure this occurs.”

The bank also pointed to “heightened geopolitical and climate condition” as a risk for inflation - which has hit global shipping costs. It said that the bank remains alert and “will act to limit spillovers into general inflation if necessary”.

The decision came with the heftier Monetary Policy Statement in which the bank produces a significant paper discussing the economic outlook and its deliberations.

Overall, it paints a picture of a slowing global economy but a still pretty frothy New Zealand economy, although now, in which various pressures are slowly easing.

Immigration is a significant area that is being considered by the Government, but the monetary policy committee said that it is a two-sided picture, noting on one hand “that strong net immigration is contributing to demand, with the recent increase in rent inflation an example”. “However, net immigration also means that there are more workers available, boosting the supply capacity of the economy. Businesses are reporting that it has become much easier to find workers. In general, capacity pressures in the labour market have eased.”

It was interesting so see that within half-an-hour of Wednesday’s announcement, the two-year swap rate, which drives what banks pay for funding, had fallen 20bps to 5.01%. Markets were pricing in two OCR cuts by November but in all reality there is no certainty in that.

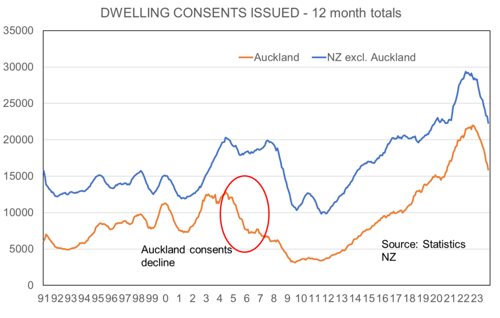

Under-Building Warning

I’m sorry to keep beating on about supply and demand but for me it is a fundamental element to many investment related considerations. There has been a lot of commentary around build numbers of late. No surprise that when the heat comes on interest rates, the motivation for developers to keep larger scale projects moving wanes significantly. The issue being the end user aka the sales tap is turned off as the yields and returns just don’t stack up at 7.29% interest rates.

Falling consent numbers could cause another new headache for the housing market. Data from the start of the month showed that there were 37,239 new homes consented in the year to December, down 25% on the year before.

Stats NZ said the 2022 figure had been the highest on record for a calendar year.

The number of multi-unit homes consented dropped 23% and the number of apartments was at its lowest since 2016. Standalone houses were down 27%.

Mike Jones, BNZ Chief Economist, said consents were trending firmly lower, despite migration pushing the population up by more than 120,000 people in the year to November.

“The number of consents issued in December was almost 40% lower than two years ago. That doesn’t mean actual building activity is set for a similarly sized decline - pandemic disruptions have distorted the lags between consents and actual building activity. But it does point to the downturn in construction deepening this year.’’

“In short, it looks like we’re underbuilding. We think a big part of this relates to record high build costs and the large gap to the cost of purchasing an existing home. Basically, the economics of building are stretched, meaning the financial incentive to build – at a macro level – is low. It’s one of the key factors likely to push up house prices this year.” Jarrod Kerr, Chief Economist at Kiwibank, said falling house prices had put potential developers off.

“Interest rates are high as well; the cost of construction has been quite high in recent years. All those things point to a slowdown in supply which doesn’t help. If we look at the housing market in isolation, we need a lot more supply. We need to do things to stimulate supply. But we’ve got an inflation problem and the Reserve Bank is trying to cool everything down on the demand side.”

He said measures to discourage investors had been unhelpful in fixing the “true problem” of the housing market. “When you restrict supply, you boost prices more than otherwise would be the case. It doesn’t help affordability at all.”

Miles Workman, a Senior Economist at ANZ, agreed the drop was not unexpected given high interest rates. “The combo of surging net migration alongside the current downward trend in consenting activity means NZ certainly has a widening housing deficit problem.”

Apply your property investment cap to that and it equates to retained pressure on rents and sustained capital growth - which are all on the long term buy and hold investors check list I’m sure.

The chances are firm that the number of consents being issued for new dwellings, to be constructed will this year, will fall below the 32,000 recently predicted by MBIE.

And To The Local Market...

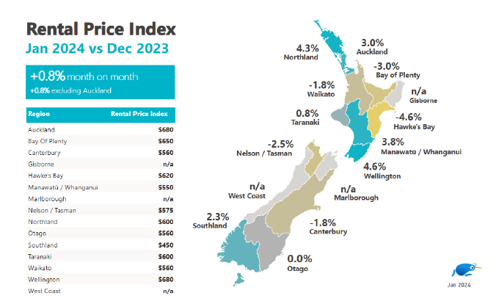

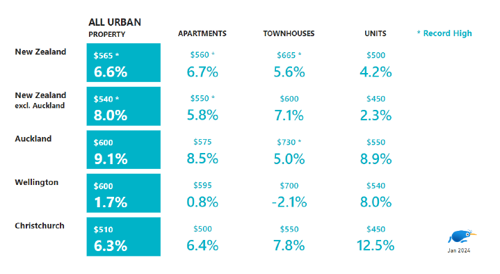

New Zealand rental prices have increased for the second month in a row according to Trade Me’s latest Rental Price Index, including rents for apartments and townhouses which have climbed to record highs.

The latest data reveals that the national median weekly rent in Aotearoa has jumped to $630 for the month of January up 0.8 percent compared to December 2023.

Trade Me’s Property Sales Director Gavin Lloyd, said the first month of the year could be a telling sign of the year ahead. “Renters were for the most part sheltered from any major price increases for rental properties at the end of 2023.”

“As borrowing costs rise, landlords may face increased expenses, and some could pass on these costs to tenants through higher rents. This change might make it a bit tougher for renters with the rising cost of living and lack of properties available giving them fewer options when searching for a property,” said Lloyd.

Across the country, the median rental prices for both apartments and townhouses reached record highs in January. The median weekly rent for an apartment in New Zealand peaked at $560 per week in January and townhouses reached $665 per week.

In Auckland specifically, townhouses also reached an all-time high of $730 - up five per cent compared to the same time last year. Units in Christchurch also saw a large jump, up 12.5 per cent - making the median rent $450.

"As net migration is almost at an all-time high more people are coming into the country looking for entry level rentals like apartments and townhouses - especially as they are more prevalent in our city centres. This increase in demand is likely putting pressure on the supply and impacting prices,” says Lloyd.

From a micro view to the local market, we are in very much the same sort of place we were last month, in fact, there are only four more properties available today as there was this time last month.

Numbers attending viewings remain strong, with the quality of those attending being a mixed bag. The last thing we’d do is tenant a property for the sake of tenanting it, that is where the problems start. Our tenant selection process has been well honed over the years and only those we think would be the right people and right fit are recommended.

Unfortunately, due to stock shortages and the cost-of-living crisis, there are some desperate people out there. Everyone deserves a warm, dry, secure property to live in but the current market, stock levels and tenancy laws don’t align for that to happen.

Rents remain strong due to the pressure within the market and we review these as allowed, for both fixed-term and periodic tenancies, landlords can only increase rent: 12 months after the date the tenancy started provided the increase is not within 12 months from when the last increase took effect.

There is a cost in tenant churn, so we do try to encourage tenants (good ones) to stay as long as possible, increasing the rent to above market is a sure way to move someone on, it is always a fine line between maximum market rent, minimum vacancy and tenant churn.

As always, we do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.

Hamish and the Team @A1