March 2023 Market Update

As we move into the start of Autumn here in the Garden City our thoughts go out to those that have been affected by Cyclone Gabrielle and the extreme weather events the North Island has been experiencing. With memories of what it was like here post the earthquakes it will be a heart-breaking time for those that have lost homes and loved ones.

No Surprises with the OCR

There were no surprises last week when the Reserve Bank (RBNZ) lifted the OCR 50 basis points to 4.75% in what was the first RBNZ policy announcement of the year.

From what I read, most Economists had forecast the increase in the run up to the announcement, as the central bank continues with its efforts to try and reduce inflation. The OCR is expected to peak at 5%, though it's no longer thought to hit the 5.5% that was originally forecast.

I find this an interesting decision to have made against the backdrop of the devastating storms that have hit the northern and eastern parts of New Zealand this summer - the repair costs of which are forecast to be in the billions.

"It is too early to accurately assess the monetary policy implications of these weather events, given that the scale of destruction and economic disruption are only now becoming evident," the bank said. "The timing, size, and the nature of funding the Government’s fiscal response are also yet to be determined."

Fixed Term or Periodic?

I know that this may not be new to some of you but here at the coalface we see the ever-changing adaptation to the changes in Tenancy Law daily. On 11 February 2021 the law changed with respect to fixed term tenancies. The main point being if the fixed term tenancy was signed on or after 11 February 2021 and if the fixed-term is for longer than 90 days, the tenancy will automatically become a periodic tenancy when it ends, there is no choice in that anymore.

Let’s recap on the two types of tenancies; A fixed term tenancy is a tenancy agreement that is set for a specific period of time, such as six months or a year. The start and end dates are specified in the tenancy agreement, and the tenant is obligated to stay for the full term. Although they are now also able to assign the balance of their tenancy to another party, effectively breaking their fixed term and we cannot deny them this choice.

On the other hand, a periodic tenancy has no set end date and continues until either the landlord or tenant gives notice to end the tenancy. This type of tenancy can offer more flexibility for both the landlord and tenant, as either party can end the tenancy with notice.

Right of Renewal Now Sits With the Tenant

As I mentioned above, previous to the law change, a fixed-term tenancy ended on the date specified in the tenancy agreement with the landlord having the right of renewal.

Now the tenant has the right of renewal so they need to give 28 days’ notice before the expiry date of the fixed term if they wish to vacate otherwise it becomes periodic. The landlord can only end the tenancy if the tenant agrees, with notice of intent to move in themselves, sell, carry out extensive renovations, demolish the building or convert to commercial. The landlord can no longer end the tenancy for no reason with a 90 day notice or just because they don’t “like” the tenant.

So even though we currently offer and negotiate a new fixed term, if the tenant doesn’t sign the renewal it will automatically roll onto a periodic lease anyway.

With this in mind, we see there is now very little difference in negotiating another fixed term versus it rolling onto periodic. The rent is still able to be increased, the tenants can give notice and they can assign their rights to the tenancy. One advantage we are seeing for periodic tenancies is a slightly lower churn rate.

For example; a tenant has plans for later in the year so another full fixed term is not what they are seeking but would like to remain in the property after their initial fixed term. The tenancy rolls to periodic and they remain in the property for the period that suits them. Naturally rent is kept in line with the market every 12 months. If they then move out after 18 month of tenancy in total the rent is able to be re adjusted for the new tenancy. The old way would have been for them to have a fixed term and if another year didn’t suit they may have well moved out after the first 12 months.

For many of us, myself included, fixed term was the way forward, now after that initial first period I am of the mind that periodic is. The reason is, it gives the Owner more options and flexibility than a fixed term once did. It is easier to deal with rent arrears within a periodic tenancy, three strikes within 90 days and you’re done, the same with anti-social behavior. If a tenant was to assign their fixed term there was no ability to increase the rent. However, with a periodic when the tenancy ends, as opposed to it being assigned, market rent can be reassessed even if it is within the 12-month period of the last adjustment. This is ever important in the current market with rents on the up.

And to the Local Market...

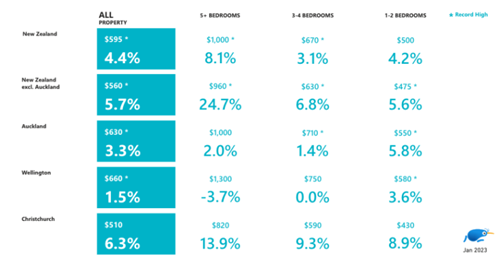

The sugar rush we saw come through the market December and January is reflected in the latest trademe data which has seen the average rent push north to $510pw.

The stats lag a bit and while we are still finding a good enquiry rate I will be interested in next month’s data as I feel those rents have come off a little. Over the last 7.5 weeks we have rented a massive 96 properties across the city which is reflective of the team’s hard work over this busy time.

Once again, this month we find that the market is tight, last month I said “stock is low, very low” well this month we take it to a new level. Yesterday we had only 601 properties available within the City which increased slightly this morning to 612. This is the lowest I have seen stock since the squeeze of post-quake Christchurch and a far cry from the 2550 we had available in the height of the re-build. So, it comes as no surprise that rents are remaining firm and have crept north $10 per week over the last month’s data set.

As always, we do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.

Hamish and the Team @A1