July 2025 Market Update

Here in the heart of the mainland and being a staunch one eyed Cantab, the recent headlines of “South Island leads country’s slow recovery” and “The south surges while north stalls” warmed the cockles of my heart. Not in the sense that there is any joy in the north not doing well but more in the sense of we knew it was coming and now its reality.

Kiwibank Chief Economist, Jarrod Kerr, singled out Christchurch as an emerging star.

“Now the city is just so cool. It’s fun to walk around. I imagine it’s fun to live there. You don’t have the traffic that Auckland’s got. You don’t have the burst pipes that Wellington has got.”

All pretty positive stuff as a district and equally important as an investor in our province. There is no doubt that housing will remain in demand as we continue to grow.

Is There Positive Economic Outlook For Employment in Christchurch?

The Parakiore Recreation and Sport Centre will be the largest aquatic and indoor recreation and leisure venue of its kind in New Zealand; the Christchurch City Council is seeking to fill over 200 vacancies before it opens shortly.

In addition to that, One New Zealand stadium at Te Kaha Chief Executive, Caroline Harvie-Teare, said they would likely need 1000 casual event staff when the stadium opened.

With these 1200 or so additional positions in the face of the news showing positive change for employment in Christchurch versus the website Seek NZ which showed job ads across NZ fell 3% in June from a month earlier, and were 3% lower than a year ago. Seek country manager, Rob Clark, said job ad levels remained broadly flat for the past year across NZ in general.

Central Canterbury Bucks the Building Trend

Central Canterbury is bucking the national trend as new homes continue to go up in the Selwyn and Ashburton districts. Nationally, the building sector has had a slowdown, with recent Stats NZ figures showing the number of new builds was down 3.8% in the year to May 2025. But Selwyn and Ashburton have both experienced booms in recent times and now, after a plateau, the numbers are trending back up in both districts.

Now our team in the Rolleston Office, will tell you how fast Selwyn and in particular Rolleston is growing. In the last 10 years, Selwyn (which includes Rolleston and Lincoln) has had 14,647 new homes consented, an average of 1627 per year!! That is a lot, no matter which way you look at it.

In the 2024-25 year, it issued 1378 consents, a 7.2% increase on the previous year.

Council Director of Development and Growth, Robert Love, said that looking ahead to the current financial year, he is expecting growth to be “higher than we have seen in the previous two financial years”, but not near the peak years of 2020/21 (1949) and 2021/22 (2175).

Back in the city, Christchurch City Council head of planning and consents Mark Stevenson, also reported a 4% drop, with the 2998 new build consents in 2024/25, down from 3124 the previous year, but both above the 10-year average of 2500.

“Annual consent numbers have varied over the past decade, ranging from around 1700 to 3900 new homes. Assuming no significant changes in market conditions or demand for new housing in Christchurch, it is reasonable to expect that future consent levels will remain broadly in line with historical trends for additional housing,” Stevenson said.

More Changes To The RTA Coming…

There’s nothing as constant as change and today we dive into the Residential Tenancies Act (RTA) amendments coming up at the end of this year or early next year, depending on when they are enacted by an order in council.

As part of the fourth phase of the Residential Tenancies Amendment Act 2024, a major set of reforms is on the way, and this time the spotlight is on pets. As mentioned, these new laws are set to take effect from late 2025 or early 2026, and they represent a significant shift in how landlord, tenants and property managers must approach pet ownership in residential properties.

Whether it’s charging a pet bond, approving a new furry friend, or dealing with damage caused by a pet, the rules have changed, and understanding your rights and responsibilities has never been more important as now it comes with some teeth, wee pun there but there are fines for not getting it right. Fines for tenants too, it’s going to an unlawful act to have a non-approved pet ($750) and fines for landlords for also ($1500). Don’t get me started on how tenants’ fines are only half of landlords, that’s a talk for another day.

With the changes, Landlords may charge a pet bond (up to two weeks rent) only if they formally consent to a tenant keeping a pet. The bond must be tied to an actual approved pet and cannot be charged pre-emptively. Only one pet bond per tenancy, regardless of how many pets the tenant has or replaces and also pet bonds cannot be charged retrospectively for tenancies that began before the new rules took effect.

Landlords cannot charge pet bonds for disability assist dogs, as these are not considered pets under the RTA. There are some tight rules around what is a verified assist dog, so it’s not an easy win for someone trying to skirt the new rules.

Tenants may apply for a refund of the pet bond at any point, if the pet is no longer kept at the property, the refund process does not require the tenancy to end first. If damage has been found, proper evidence and agreement or a Tribunal ruling would be required for any deductions.

Written consent or specific allowance in the tenancy agreement is required to keep a pet, without written approval, keeping a pet is unlawful.

Now the other side of the coin, Landlords cannot insert blanket “no pets” clauses without reasonable justification. Any pet prohibition must include clear, reasonable grounds or it is legally unenforceable. Unreasonable pet related conditions are not allowed.

Tenants must make a written request if the tenancy agreement does not already allow pets. Landlords have 21 days to respond in writing, the response must include the decision, any reasonable grounds if approved (pet bond, carpet cleaning, lawn repair, regular disposal of pet waste, securing pet during inspections etc) or specific grounds if the request is declined.

Reasonable grounds for refusing pets must be based on valid property related reasons such as body corp legal restrictions, too many pets already at the property or the property is unsuitable, for example, a large dog, small unit, unfenced etc.

Tenants may be fully liable for damage resulting from keeping a pet. Pet related damage is now considered a direct liability regardless of insurance cover.

House Prices Hit Nine Month Low In June (Great Time To Buy)

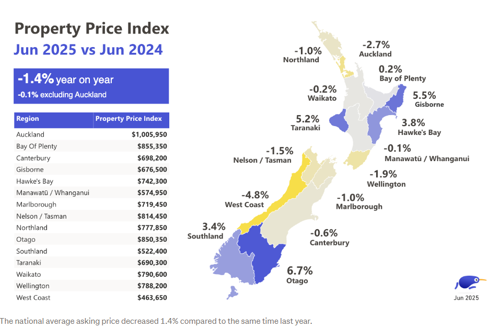

The national average asking price has fallen to its lowest since September 2024. In June the average asking price was $829,650, down more than $15,000 (-1.8%) on May and -1.4% year-on-year.

Trade Me Property Customer Director, Gavin Lloyd, said Auckland prices have taken the largest hit.

“Auckland has seen the largest decline in the average asking price, from both a month-on-month (-2.4%) and year-on-year perspective (-2.7%).

“If we look at the price in June, and compare it to the same time last year it shows a fall of close to $28,000. That said, the average asking price of property in New Zealand’s largest city continues to hold above the million dollar mark (at $1,005,950), $150,000 more than the Bay of Plenty, which is the next most expensive region,” said Lloyd.

The average asking price for a property in Otago has grown by close to $54,000 in the year to June, a 6.7% increase. There are four districts within the region driving the increase, Waitaki where prices are up 2.8% year-on-year, Dunedin (+2.2%), Queenstown Lakes (+1.8%) and Wānaka (+1.3%).

“Otago is a huge and diverse region, it’s laid-back, incredibly scenic and is particularly appealing for lovers of the great outdoors, a wonderful place to call home. With recent Census figures showing increasing Kiwis to be moving south it will be interesting to see if the growth in house prices in Otago continues its steady upward trajectory,” says Mr Lloyd.

Outside of Otago, Southland has also made good gains across the year with the average asking price up 3.4% or around $17,000.

“The average price in Southland in June was just over $522,000, so while it’s on the up, it still remains one of the most affordable regions across the island.”

Further north, both Hawkes Bay and Taranaki show strong year-on-year growth. The average asking price in Taranaki is up 5.2% or close to $35,000, while Hawkes Bay prices have increased 3.8% year-on-year, the equivalent of more than $27,000.

Supply And Demand Both Fall In Tandem

The number of listings on Trade Me Property, which hit a decade high in March, fell 9% between May and June but remained 4% up year-on-year. Demand was also down 12% on the month prior but flat compared to June 2024.

“Seeing supply dip at this stage of the year isn’t unexpected, but there remains plenty of choice in the market for those house hunting with several thousand more properties listed on site than the same month last year,” says Mr Lloyd.

The median number of days onsite increased from 70 in May to 78 in June.

To me this represents value, when I look at the property clock we are at the bottom of the market, it’s only up from here. Spring is coming and winter is the time for savvy property moves. A recent survey of over 2,800 prospective buyers and homeowners revealed that only 14% of homeowners believe winter is a good time to sell, so that presents opportunity.

For buyers, winter provides a unique opportunity to truly assess a property. Many use the colder, wetter conditions to their advantage, checking how well a home holds up. This means you can spot any potential issues before making a big decision. Plus, winter buyers enjoy: Less Competition: 47% of winter buyers are motivated by less competition in the market. Better Deals: 45% of winter buyers are hoping for a better deal.

Abundant Choices in Today's Market Landscape

Supply within Christchurch has blown out this month, with around 1386 properties available. Last July, supply had just topped 1000 for the first time in 36 months and last month we sat at around 1246. I expect to see our current number come back to more around 1250 once the flush of student letting is finished.

On the theme of students, our University or student letting has commenced this month. The University of Canterbury (UC) is brimming with almost 25,000 students. The affiliated University of Canterbury halls or student accommodation, is at 100% occupancy and new applications are being added to a waiting list. We are experiencing this demand also as large numbers of first year students apply for our student flats.

We simply don’t have the stock to satisfy the current demand; one property had over 80 groups booked to view, with over half of those making application. So that one five-bedroom property saw 400 viewers, 200 applications, five happy people and 195 still looking. Another couple of properties a stone’s throw from UC, had a line 400m down the road! As an investor, I cut my teeth in the student market with several properties, it’s a fun market to be part of, as with any, it has its nuances that we understand well.

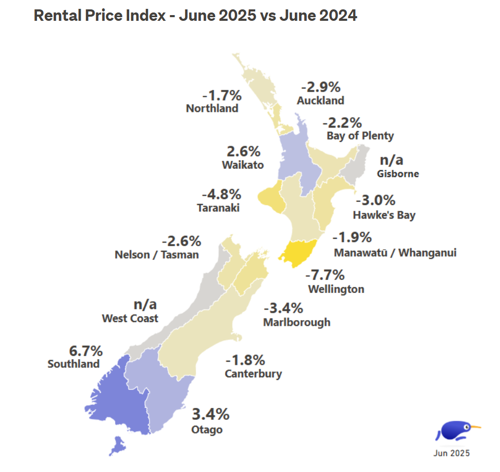

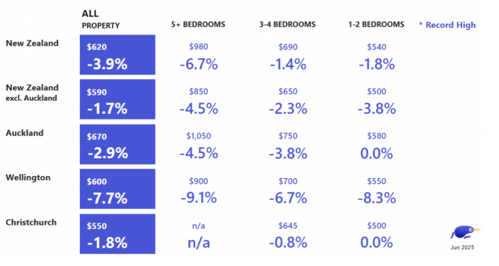

Across the country, the national median weekly rent continued to fall to $620 per week in June, down $20 since January.

After reaching $650 in May last year, the national median rent steadily eased to $635 in March and $630 in April. While it held steady in May, in June it dropped again to $620, a welcome trend for renters nationwide.

This June figure represents an overall 3.9% year-on-year decrease with supply increasing 20% in the year to June while demand cooled 18%.

Trade Me Property Spokesperson, Casey Wylde, said, "the easing of rental prices, coupled with increased listings and less competition, is creating a more favourable environment for renters, offering them more choice and potentially better negotiating power."

While Wellington boasts the most significant annual drops, the rest of the country was a mixed bag.

The lower South Island continues to see annual rent increases. Southland still leads the pack for year-on-year increases, up 6.7% to $480. Otago also maintained strong year-on-year growth at 3.4% to $600.

Wellington's rent declines affected all property sizes and urban dwelling types in June. Large properties (five plus bedrooms) saw a 9.1% drop to $900, while three to four-bedroom homes fell 6.7% to $700. Smaller properties (one to two bedrooms) recorded an 8.3% drop to $550 in June.

When we look at urban properties (townhouses, apartments and units) specifically, Wellington's market experienced an overall 7.6% decrease. This includes a 9.3% drop to $535 for apartments and a 4.4% drop for townhouses to $650, with units remaining steady at $520. Auckland and Christchurch also saw declines across various property types.

That’s probably enough of my insomnia curing for now, as you can possibly tell, I love property and talking about it so tend to go on a bit. My takeaways this month - now’s the time to hunt out a bargain, we are at or past the bottom of the market, money will get cheaper with further stimulus required across the country, sure there are more property’s available but they’ll rent (especially in Christchurch as people want to live here!).

As always, we do truly appreciate your business and the team and I are always just a phone call away. We are always available for a free chat and are happy to share our experience and knowledge wherever we can be helpful.